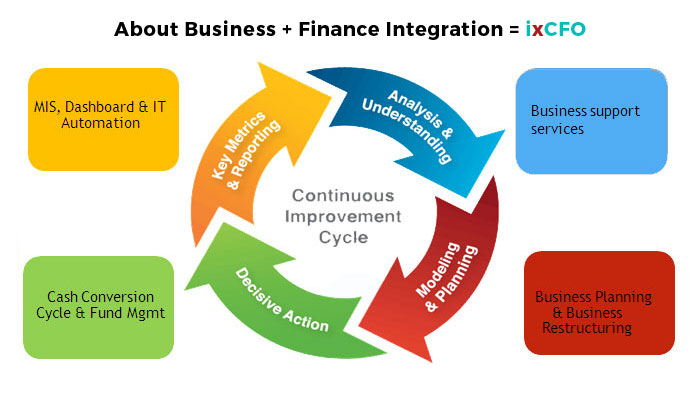

Fx =Financal Health (x) management & Business support

Creating robust management accounting system to capture the business results, by accessing intelligent data & creating business finance report based on development of sound decision support system

Managing cash conversion cycle & banking functions with strong linkages to financial supply chain

Capturing inherent risk & mitigating risk factors in operating business plan of the business with laying processes on regular annual budget & periodical rolling outlook and its alignment with long term business & financial strategy.

Internal audit, tax & legal compliance management by laying emphasis on good governance practices Maintaining key relationships with external stakeholders like Investor, Banker, JV Partner, Customers etc.

.png)